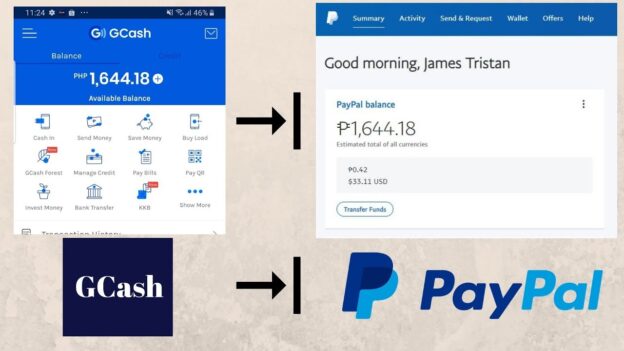

Transferring Funds Between GCash and PayPal

Are you searching for a way to transfer funds between your GCash and PayPal accounts? Look no further – in this article we will walk through the steps of moving money between accounts either way. With these steps, it should be simple for you to manage your finances and make payments online with ease.

What is GCash?

GCash is a mobile wallet in the Philippines that enables users to pay bills, buy load or data plans, transfer funds and invest in mutual funds all from within one convenient app. GCash provides an easy and seamless way to conduct cashless transactions via your smartphone, with over 20 million users already accessing it in over 100 countries worldwide. (source)

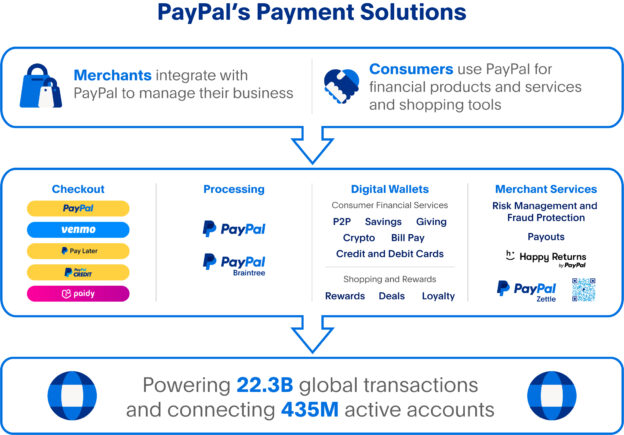

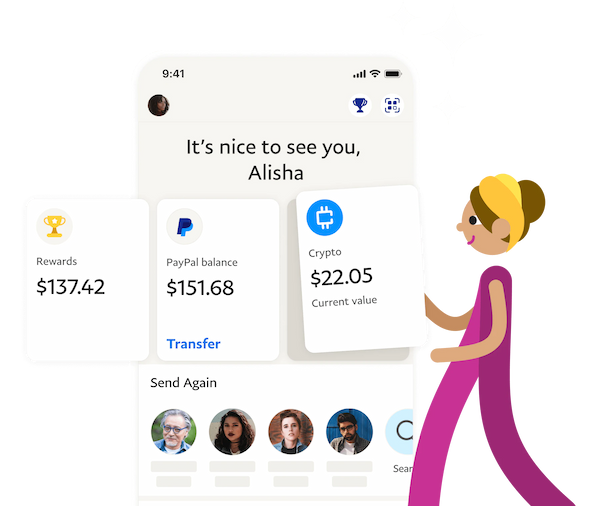

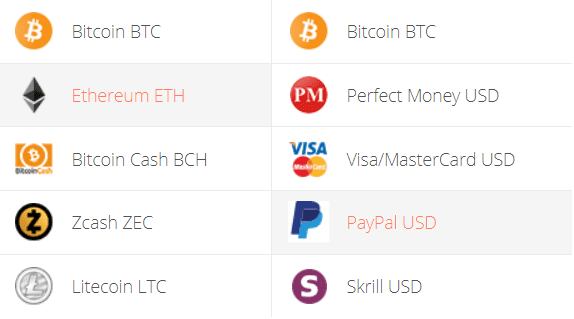

What Is PayPal (Pal PayPal)?

PayPal is an online payment system used by millions worldwide to safely complete secure transactions over the internet and make purchases, send/receive money transfers and pay bills online. PayPal provides an efficient and safe way of managing finances without carrying cash or using credit cards. (source)

To connect GCash to PayPal, follow these easy steps:

- Log into your PayPal account

- Make your GCash payments Click “Link a Card or Bank” under the “Wallet” tab, select “Link a Bank Account,” enter your GCash account details including its account name, account number and bank code (for PayMaya users), verify your account using One-Time Passwords sent directly to your registered mobile phone and click on “Verify Your Accounts”, follow these instructions until completed and continue with Step 6.

- Once verified, your GCash account will be linked with your PayPal account and funds can be easily transferred between the two.

To transfer funds from GCash to PayPal: Simply follow these steps:

- Log into your GCash account

- Select “Bank Transfer” under the “Send Money” tab

- Confirm bank details Simply select PayPal as the bank destination and enter the amount to transfer.

- Provide your PayPal email address and click “Next”, while reviewing and accepting transaction details before clicking “Confirm”

Your funds should arrive in PayPal within 24-48 hours from GCash.

To transfer funds from your PayPal account to GCash, follow these steps:

- Log into PayPal

- Select “Withdraw Funds” under “Wallet”.

- Choose “Withdraw funds to Your Bank Account”.

- Choose “GCash MasterCard” as the bank, enter the amount, review transaction details, and click “Continue”. Once done, complete withdrawal by entering One-Time Password (OTP).

Your funds should arrive from PayPal into GCash within 24-48 hours, following these tips for a smooth transfer:

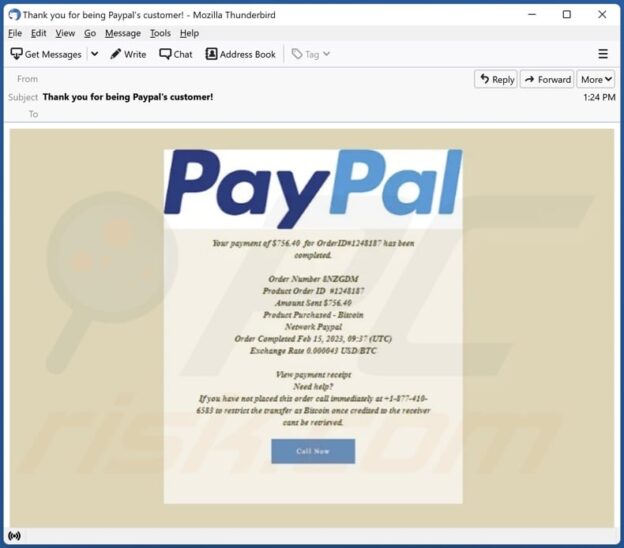

- Make sure that both accounts are linked properly before initiating transfers between accounts.

- Verify all details such as account numbers and emails addresses before finalizing transactions.

- Check for fees or charges applicable when moving funds between accounts.

- Keep track of all transactions by viewing your transaction histories on both GCash and PayPal.

Fund transfers between these popular digital wallets is simple and effortless – perfect for managing finances with ease! No matter if it’s paying bills or shopping online, GCash and PayPal provide safe and secure ways of making cashless transactions.

Referencing: 1. “GCash: Buy Load, Pay Bills and Send Money.” GCash, 2. “PayPal: Send Money Online or Set Up Merchant Account.” PayPal